|

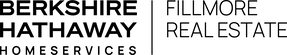

If you’re following today’s housing market, you know two of the top issues consumers face are inflation and mortgage rates. Let’s take a look at each one. Inflation and the Housing Market This year, inflation reached a high not seen in forty years. For the average consumer, you probably felt the pinch at the gas pump and in the grocery store. It may have even impacted your ability to save money to buy a home. While the Federal Reserve is working hard to lower inflation, the August data shows the inflation rate was still higher than expected. This news impacted the stock market and fueled conversations about a recession. It also played a role in the Federal Reserve’s decision to raise the Federal Funds Rate last week. As Bankrate says: “. . . the Fed has raised rates again, announcing yet another three-quarter-point hike on September 21 . . . The hikes are designed to cool an economy that has been on fire. . .” While their actions don’t directly dictate what happens with mortgage rates, their decisions have contributed to the intentional cooldown in the housing market. A recent article from Fortune explains: “As the Federal Reserve moved into inflation-fighting mode, financial markets quickly put upward pressure on mortgage rates. Those elevated mortgage rates . . . coupled with sky-high home prices, threw cold water onto the housing boom.” The Impact on Rising Mortgage Rates Over the past few months, mortgage rates have fluctuated in light of growing economic pressures. Most recently, the average 30-year fixed mortgage rate according to Freddie Mac ticked above 6% for the first time in well over a decade (see graph below): The mortgage rate increases this year are the big reason buyer demand has pulled back in recent months. Basically, as rates (and home prices) rose, so did the cost of buying a home. That pushed on affordability and priced some buyers out of the market, so home sales slowed and the inventory of homes for sale grew as a result. Where Experts Say Rates and Inflation Will Go from Here Moving forward, both of these factors will continue to impact the housing market. A recent article from CNET puts the relationship between inflation and mortgage rates in simple terms: “As a general rule, when inflation is low, mortgage rates tend to be lower. When inflation is high, rates tend to be higher.” Sam Khater, Chief Economist at Freddie Mac, has this to say about where rates may go from here: “Mortgage rates remained volatile due to the tug of war between inflationary pressures and a clear slowdown in economic growth. The high uncertainty surrounding inflation and other factors will likely cause rates to remain variable, . . .” While there’s no way to say with certainty where mortgage rates will go from here, there is something you can do to stay informed, and that’s connect with a trusted real estate advisor. They keep their pulse on what’s happening today and help you understand what the experts are projecting. They can provide you with the best advice possible. Bottom Line Rising inflation and higher mortgage rates have had a clear impact on housing. For expert insights on the latest trends in the housing market and what they mean for you, let’s connect.

0 Comments

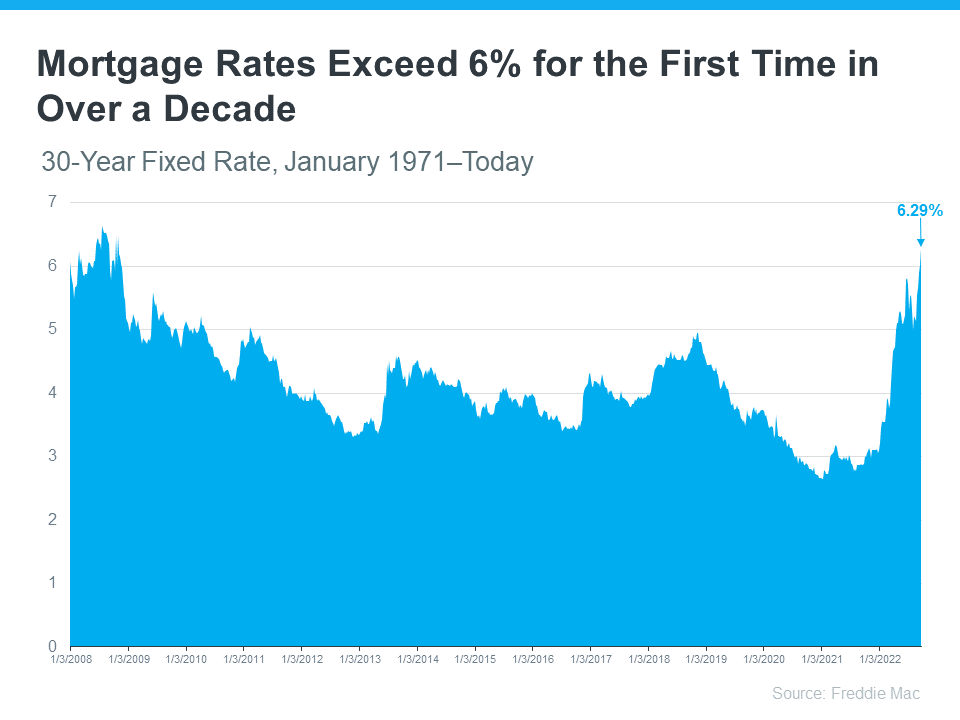

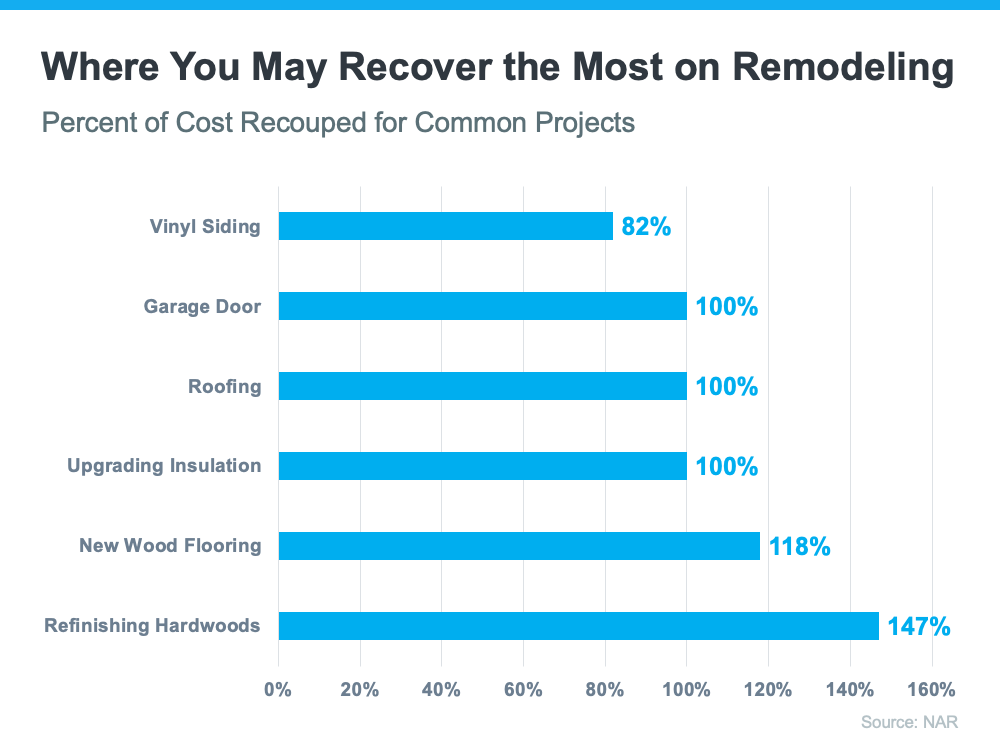

Some people believe there’s a group of homeowners who may be reluctant to sell their houses because they don’t want to lose the historically low mortgage rate they have on their current home. You may even have the same hesitation if you’re thinking about selling your house. Data shows 51% of homeowners have a mortgage rate under 4% as of April this year. And while it’s true mortgage rates are higher than that right now, there are other non-financial factors to consider when it comes to making a move. In other words, your mortgage rate is important, but you may have other things going on in your life that make a move essential, regardless of where rates are today. As Jessica Lautz, Vice President of Demographics and Behavioral Insights at the National Association of Realtors (NAR), explains: “Home sellers have historically moved when something in their lives changed – a new baby, a marriage, a divorce or a new job. . . .” So, if you’re thinking about selling your house, it may help to explore the other reasons homeowners are choosing to make a move today. The 2022 Summer Sellers Survey by realtor.com asked recent home sellers why they decided to sell. The visual below breaks down how those homeowners responded: As the visual shows, an appetite for different features or the fact that their current home could no longer meet their needs topped the list for recent sellers. Additionally, remote work and whether or not they need a home office or are tied to a specific physical office location also factored in, as did the desire to live close to their loved ones. The realtor.com survey summarizes the findings like this: “The primary reason homeowners decided to sell in the last year was the realization that, after so much time spent at home, they wanted different features and amenities, such as walkability, outdoor space, pool, etc. . . . ” If you, like the homeowners they surveyed, find yourself wanting features, space, or amenities your current home just can’t provide, it may be time to consider listing your house for sale. Even with today’s mortgage rates, your lifestyle needs may be enough to motivate you to make a change. The best way to find out what’s right for you is to partner with a trusted real estate professional who can provide expert guidance and advice throughout the process. They can help walk you through your options, so you can make a confident decision based on what matters most to you and your loved ones. Bottom Line While the financial reasons for moving are important, there’s often far more to consider. Non-financial reasons can also be a significant motivating factor. If you need help weighing the pros and cons of selling your house, let’s connect today. There’s no denying the housing market is undergoing a shift this season as buyer demand slows and the number of homes for sale grows. But that shift actually gives you some unique benefits when you sell. Here’s a look at the key opportunities you have if you list your house this fall. Opportunity #1: You Have More Options for Your Move One of the biggest stories today is the growing supply of homes for sale. Housing inventory has been increasing since the start of the year, primarily because higher mortgage rates helped cool off the peak frenzy of buyer demand. But what you may not realize is, that actually could benefit you. If you’re selling your house to make a move, it means you’ll have more options for your own home search. That gives you an even better chance to find a home that checks all of your boxes. So, if you’ve put off selling because you were worried about being able to find somewhere to go, know your options have improved. Opportunity #2: The Number of Homes on the Market Is Still Low Just remember, while data shows the number of homes for sale has increased this year, housing supply is still firmly in sellers’ market territory. To be in a balanced market where there are enough homes available to meet the pace of buyer demand, there would need to be a six months’ supply of homes. According to the latest report from the National Association of Realtors (NAR), in July, there was only a 3.3 months’ supply. While you’ll have more options for your own home search, inventory is still low, and that means your home will still be in demand if you price it right. That’s why the most recent data from NAR also shows the average home sold in July still saw multiple offers and sold in as little as 14 days. Opportunity #3: Your Equity Has Grown by Record Amounts The home price appreciation the market saw over the past few years has likely given your equity (and your net worth) a considerable boost. Danielle Hale, Chief Economist at realtor.com, explains: “Homeowners trying to decide if now is the time to list their home for sale are still in a good position in many markets across the country as a decade of rising home prices gives them a substantial equity cushion . . .” If you’ve been holding off on selling because you’re worried about how rising prices will impact your next home search, rest assured your equity can help. It may be just what you need to cover a large portion (if not all) of the down payment on your next home. Bottom Line If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today. Owning a home is a major financial milestone and an achievement to take pride in. One major reason: the equity you build as a homeowner gives your net worth a big boost. And with high inflation right now, the link between owning your home and building your wealth is especially important. If you’re looking to increase your financial security, here’s why now could be a good time to start on your journey toward homeownership. Owning a Home Is a Key Ingredient for Financial Success A report from the National Association of Realtors (NAR) details several homeownership trends, including a significant gap in net worth between homeowners and renters. It finds: “. . . the net worth of a homeowner was about $300,000 while that of a renter’s was $8,000 in 2021.” To put that into perspective, the average homeowner’s net worth is roughly 40 times that of a renters This difference shows owning a home is a key step in achieving financial success. Equity Gains Can Substantially Boost a Homeowner’s Net Worth The net worth gap between owners and renters exists in large part because homeowners build equity. When you own a home, your equity grows as your home appreciates in value and you make your mortgage payments each month. As a renter, you don’t have that same opportunity. A recent article from CNET explains: “Homeownership is still considered one of the most reliable ways to build wealth. When you make monthly mortgage payments, you're building equity in your home . . . When you rent, you aren't investing in your financial future the same way you are when you're paying off a mortgage.” But on top of that, your home equity grows even more as your home appreciates in value over time. That has a major impact on the wealth you build, as a recent article from Bankrate notes: “Building home equity can help you increase your wealth over time, . . . A home is one of the only assets that have the potential to appreciate in value as you pay it down.” In other words, when you own your home, you have the advantage of your mortgage payment acting as a contribution to a forced savings account that grows in value as your home does. And when you sell, any equity you’ve built up comes back to you. As a renter, you’ll never see a return on the money you pay out in rent every month. Bottom Line Owning a home is an important part of building your net worth. If you’re ready to start on your journey to homeownership, let’s connect today. If you’ve been thinking of buying a home, you may have been watching what’s happened with mortgage rates over the past year. It’s true they’ve risen dramatically, but where will they go from here, especially as the market continues to slow? As you think about your homeownership goals and decide if now’s the time to make your move, the best place to turn to for that information is the professionals. Here’s a summary of the latest mortgage rate forecasts from housing market experts. Experts Project Mortgage Rates Will Stabilize While mortgage rates continue to fluctuate due to ongoing inflationary pressures and economic uncertainty, experts project they’ll start to stabilize in the months ahead. According to the latest projections, mortgage rates are expected to hover in the low to mid 5% range initially, and then potentially dip into the high 4% range by later next year (see chart below): That could bring you some welcome relief. So far this year, mortgage rates have climbed over two percentage points due to the Federal Reserve’s response to inflation, and that’s made it more expensive to buy a home. And wondering if the rise in rates will continue is keeping some prospective buyers on the sidelines. But now that experts say mortgage rates should stabilize, this gives you a bit more certainty about what they think the future holds, and that may help you feel more confident about your decision to buy a home. Bottom Line Whether you’re looking to buy your first home, move up to a larger home, or even downsize, you need to know what’s happening in the housing market so you can make the most informed decision possible. Let’s connect to discuss your goals and determine the best plan for your move. In a market that’s shifting as fast as it is today, many homeowners wonder what, if anything, needs to be renovated before they sell their house. That’s where a trusted real estate professional comes in. They can help you think through today’s market conditions and how they impact what you should – and shouldn’t – do before selling your house. Here are some considerations a professional will guide you through. What You Need To Know About Your Local Market Since the supply of homes for sale has increased so much this year, today’s buyers have more options than they had last year. That may mean you’re not able to ignore some of those repairs or cosmetic updates you could have skipped in previous months. As a recent article from realtor.com says: “To stand out in the market, sellers should make their home attractive to buyers, which usually means some selective updates.” The key word here is selective. Since it’s still a sellers’ market, focusing on a few key areas may be enough to make your house stand out from other options. And since inventory is still low overall, it’s also possible buyers may be willing to handle the renovations themselves once they move in. It all depends on buyer demand and the available inventory in your local area. For advice on what’s happening in your market and what to do to make your house show well, lean on a professional. Not All Renovation Projects Are Equal In addition to making sure your house makes a good first impression, you’ll also want to consider the return on your investment (ROI) for any renovations. According to the 2022 Remodeling Impact Report from the National Association of Realtors (NAR), here are the projects that could net you the best return when you sell your house (see visual below): Again, your real estate advisor is your best resource. When your agent comes to your house for a walk-thru and consultation, they’ll use their expertise to offer any insight into what you may need to repair, replace, or refinish. They also know what other sellers are doing before listing their homes and how buyers are reacting to those upgrades to help steer you in the right direction. As Dr. Jessica Lautz, Vice President of Demographics and Behavioral Insights for NAR, explains: “This year, the winner was hardwood flooring. Hardwood floor refinishing and putting in new wood flooring had the most significant value, . . .” How To Draw Buyer Attention to the Upgrades You’ve Made For any projects you’ve already completed or for those you plan to do before listing, make sure your real estate professional knows. They’re not just an advisor to help you decide where to focus your efforts, they’re also skilled at highlighting any upgrades in your listing. That way, potential buyers know about the features that may help sell them on the house. No matter what, contact a local real estate professional for expert advice on what work needs to be done and how to make it as appealing as possible to future buyers. Every home is different, so a conversation with your agent is mission-critical to make sure you make the right moves when selling this season. Bottom Line In today’s shifting market, it’s important to spend your time and money wisely when you’re getting ready to move. Lets connect to find out where to focus your efforts before you sell. |

BLOG Archives

June 2024

|

|

The Big City Team

Berkshire Hathaway HomeServices Fillmore Team HQ: 4717 Avenue N Brooklyn, NY 11234 Colin R. O'Leary Founder & Team Leader Licensed R.E. Salesperson Phone: 646-300-2012 [email protected] |

|

Your Trusted Partners in Real Estate Across the NYC Metro Area

© 2024 BHH Affiliates, LLC. An independently owned and operated franchisee of BHH Affiliates, LLC.

Berkshire Hathaway HomeServices and the Berkshire Hathaway HomeServices symbol are registered service marks of Columbia Insurance Company, a Berkshire Hathaway affiliate.

Equal Housing Opportunity.

Privacy Policy